Industry question

True or false: When a participant contributes to a health savings account through a Section 125 Plan, the contributions can be made pre-tax.

Answer: True. Contributing through a Section 125 Plan gives a participant the maximum tax savings, which includes FICA, federal, and state income tax savings. (Note: State income tax savings do not apply in CA or NJ.) If a participant contributes outside of a Section 125 Plan, they can still receive a benefit by taking an above-the-line deduction, saving on federal and state taxes.

HSA benefits: The power of one

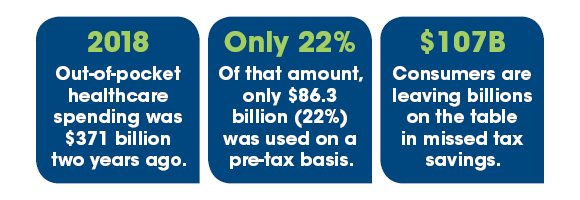

Many companies today offer a high-deductible health plan (HDHP) option and include the benefit of allowing employees to contribute to a health savings account (HSA). Offering an HSA to employees has many wonderful benefits, yet statistics show many individuals don’t take advantage of these pre-tax savings. By using one HSA administrator, you offer a more streamlined enrollment process, one consistent message to employees, and a simplified employer experience.

The power of ONE for employers and employees:

- One contact

- One website

- One stacked debit card for all benefit accounts

- One mobile app

Using a single administrator also allows for a customized education program, offering a consistent message to all employees. And having access to one dedicated Relationship Manager gives a company direct access to personalized service — a valuable resource to a company’s HR team. Additionally, having one single employer portal offers a company quick and easy access to a full suite of tools and reports, including:

- A central location to load payroll files

- The ability to view denied contributions

- Email alerts for loaded payroll files

- Reports at your fingertips, including YTD contributions and payroll reconciliation

Using one platform with industry-leading technology — like the platform offered by Health Benefit Solutions — both employers and employees can feel confident that they’re in good hands.

Source: Aite Group, Health Benefit Accounts Market Forecast: HSAs Leading the Way. June 2018.

The CARES Act and over-the-counter drugs

With the recent release of IRS Notice 2020-18 and the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, we wanted to make sure you’re aware of the changes within the Act that may impact your benefit accounts — specifically around over-the-counter medications.

The much-anticipated CARES Act was signed into law on March 27, 2020, and states that consumers can purchase over-the-counter (OTC) drugs and medications with funds from their health savings account (HSA) or flexible spending account (FSA). Consumers may also receive reimbursement for OTC purchases through those accounts. In addition, menstrual products are now considered a qualified medical expense, meaning consumers may pay or be reimbursed for these products through their HSA or FSA. This provision is effective for purchases made after December 31, 2019, and for reimbursements of expenses incurred after December 31, 2019.

A few examples of OTC drugs and medications that are now considered eligible under your HSA or FSA without a prescription include:

- Pain relief medication

- Cold and flu products

- Allergy medicine

- Menstrual products

Please note: If you try to purchase OTC or menstrual care items with your benefits card before the merchant has updated their system, the transaction may be denied. If this happens, you can submit a claim for reimbursement; just be sure to save your receipt. Merchants have been working to update their systems with the new eligible product list, but it may take some time.

Real people, real answers, in real time: Meet Tanya Martin-Dick

Tanya Martin-Dick is Vice President of Health Benefit Solutions. We asked her a few questions about who she is and what makes her tick.

What’s the best concert you’ve ever attended?

Garth Brooks

What’s your favorite place in the world?

On top of a mountain, getting ready to ski down — and the beach!

What’s the last book you read?

The Strategic Stop

What’s your favorite famous or inspirational quote?

“Whatsoever thy hand findeth to do, do it with thy might.” – Ecclesiastes 9:10

What is your favorite thing to do when you’re not working?

Play with my horses and dogs.

What’s something you’ll NEVER do again?

Run a full marathon.

What’s the most memorable gift you’ve ever received?

The gift of my son, through adoption.