The hands-off approach to investing

For a lot of investors, market volatility is a hard thing to stomach. What do they do to sleep better at night? Some may choose to get out of the market during volatile times and wait to jump back in when things settle down. Unfortunately, they may not have considered what selling their investments at their low could do to their bottom line.

The reality is that time in the market is more important than timing the market. Remember, volatility is short-lived, and those who can stomach the market lows and highs will likely reap the benefits of their consistency, perseverance, and discipline in the long run.

Instead of losing sleep over the short-term fluctuations of an exchange-traded fund (ETF), it’s better to focus on its long-term potential. Having the correct asset allocation for your comfort level can also help you control the amount of volatility you experience. Wise investors will stick with the market — riding out the lows and celebrating the highs — until they reach their destination, which is typically retirement.

Slow and steady wins the race

A Michigan study found that big stock market ebbs and flows are concentrated to just a handful of trading days per year. Between 1963-1993, only 90 days — or an average of three per year — accounted for 95% of the total return during that time.

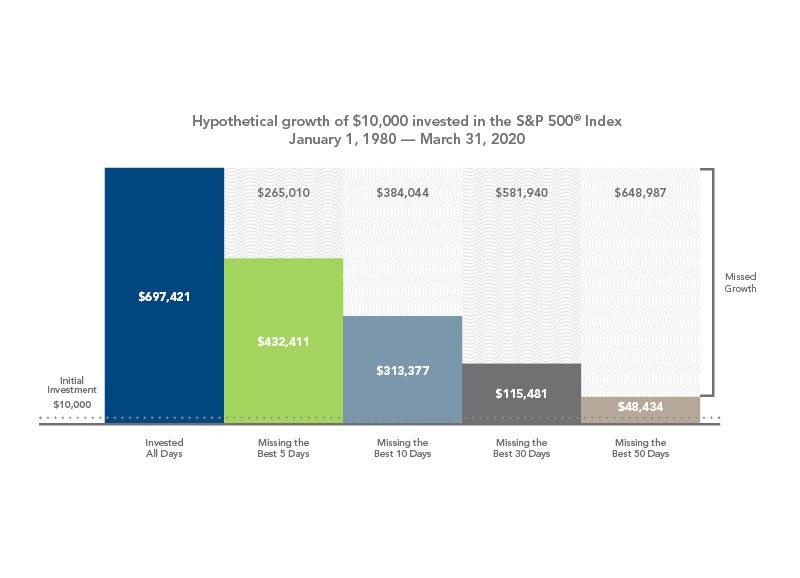

Granted, 1963 was a long time ago, but here’s an example what would happen to a hypothetical $10,000 investment into an S&P fund from 1980 to 2020 if you missed some of the best market days during that time.

Just missing the best five days of that 40-year stretch means you would lose 38% compared to being fully invested on those days. There are roughly 10,000 trading days in that time, and just missing those days you can count on one hand would mean $265,000 less in return. That’s a lot of money for a tiny percentage of days!

Emotion-free is the best way to invest

It’s best to keep your emotions out of your investments. Think about your long-term goal and dismiss the short-term market struggles. A typical DIY investor tends to let their competitiveness take over and buy when the market is rolling into new highs, then panic and make the decision to sell at low prices.

By now you may have heard of an up-and-coming investor by the name of Warren Buffett. When talking about account growth, Warren once said, “All that’s required is the passage of time, an inner calm, ample diversification, patience, and a minimization of transactions and fees.”

He’s also the guy who quipped, “We continue to make more money when snoring than when active.”

Next time the market dips and you see your account balance temporarily shrinking, resist the urge to panic. Ask yourself, “What would Warren do?” and remind yourself that Warren would ride it out.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.

|