Market Recap: April 2024

Market commentary

- Elevated wage pressure and higher-than-expected CPI readings have led to renewed inflation concerns, likely keeping the Fed on hold for longer.

- Some signs that consumer resilience is being tested, with confidence declining and companies like Starbucks and McDonalds noting an increasingly challenging environment.

- The first estimate of first-quarter GDP came in lower than expected, driven by a surge in imports and inventory build.

- Manufacturing dipped back into a contraction after growing in March for the first time since September 2022.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 1.6% | 3.4% |

| Consumer Confidence | 97.0 | 103.1 |

| Consumer Price Index Y/Y | 3.5% | 3.2% |

| Core PCE (x food & energy) | 2.8% | 2.8% |

| ISM Manufacturing Index | 49.2 | 50.3 |

| Unemployment Rate | 3.8% | 3.9% |

| 2-Year Treasury Yield | 5.04% | 4.62% |

| 10-Year Treasury Yield | 4.68% | 4.20% |

Equities

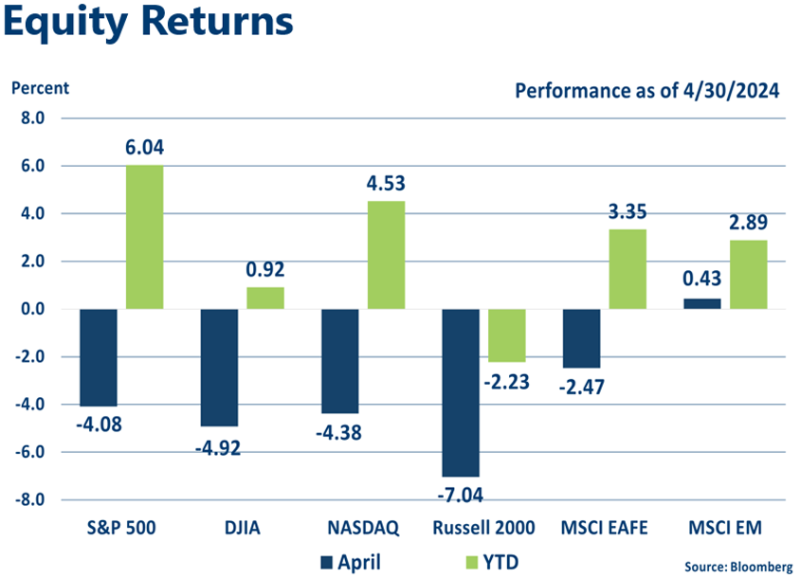

- U.S. equity markets declined for the first time in five months as inflation concerns once again took center stage.

- International markets fared better, with the developed market index posting a smaller loss than the U.S. averages and the emerging market index posting a small gain.

- The small-cap Russell 2000 index wiped out all of its gains for the year and then some, with a 7% loss in April.

Fixed income

- Fixed income returns were negative as yields jumped on higher inflation readings.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in high-growth large cap stocks after recent rally; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.