Market Recap: August 2024

Market commentary

- The Labor Department revised job figures downward, indicating that 818,000 fewer jobs were added from April 2023 through March 2024 than initially reported.

- Reflecting an upturn in private inventory investment, an acceleration in consumer spending, and offset by a downturn in residential fixed investment, second quarter GDP estimates indicate the economy expanded at an annual rate of 3.0%.

- Demonstrating improved optimism about the future, and despite concerns about the labor market, Consumer Confidence improved in August.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 3.0% | 1.4% |

| Consumer Confidence | 103.3 | 100.3 |

| Consumer Price Index Y/Y | 2.9% | 3.0% |

| Core PCE (x food & energy) | 2.6% | 2.6% |

| ISM Manufacturing Index | 47.2 | 46.8 |

| Unemployment Rate | 4.3% | 4.1% |

| 2-Year Treasury Yield | 3.92% | 4.26% |

| 10-Year Treasury Yield | 3.90% | 4.03% |

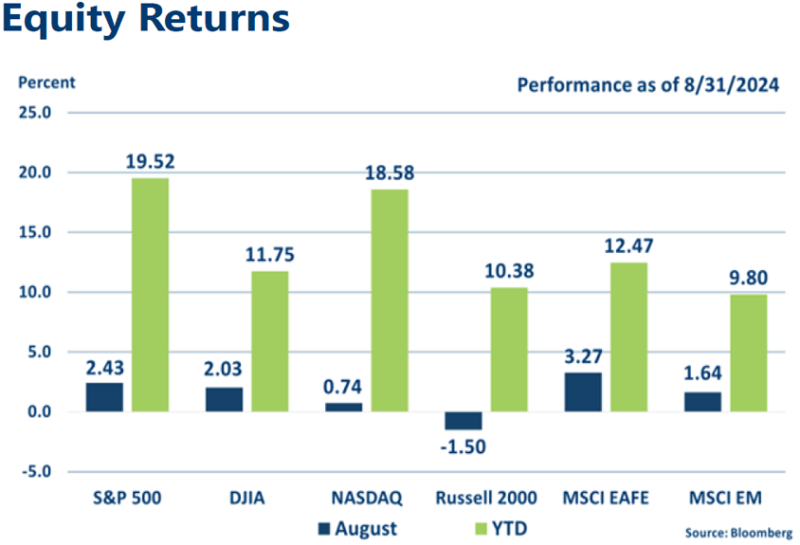

Equities

- Following sharp declines in early August, most indices rallied to finish the month with positive returns.

- The S&P 500 posted a 2.4% gain in August, exhibiting a fourth straight month of positive returns, while the small-cap Russell 2000 index declined.

Fixed income

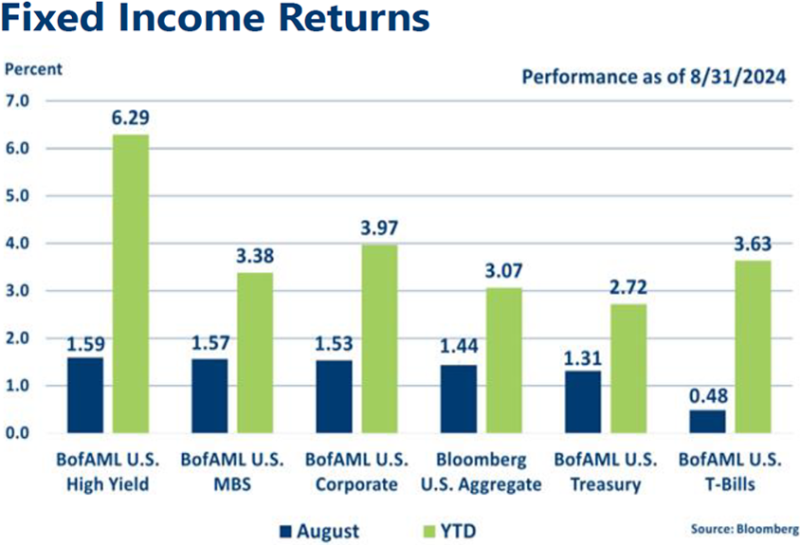

- In anticipation of Federal Reserve easing, bond yields fell across all maturities, with the 10-year Treasury decreasing from 4.26% to 3.92% during the month.

- The yield curve inversion nearly ended in August, with the 2-year Treasury yielding just 3 bps more than the 10-year at month-end.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in high-growth large cap stocks after recent rally; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Above average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.