Market Recap: June 2024

Market commentary

- Second-quarter GDP grew at a 1.4% rate, down from first quarter’s rate of 3.4%. Current expectations are that third-quarter GDP will pick up to 1.8%.

- Inflation, as measured by both the CPI and the PCE, moderated slightly in May, yet remained above the Fed target.

- Initial jobless claims rose higher than forecasted, and the unemployment rate increased to 4%.

- U.S. consumer sentiment fell for the third consecutive month in June, reflecting growing concerns among Americans about their personal finances and ongoing worries about persistent inflation.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 1.4% | 3.4% |

| Consumer Confidence | 100.4 | 102.0 |

| Consumer Price Index Y/Y | 3.3% | 3.4% |

| Core PCE (x food & energy) | 2.6% | 2.8% |

| ISM Manufacturing Index | 48.5 | 48.7 |

| Unemployment Rate | 4.0% | 3.9% |

| 2-Year Treasury Yield | 4.76% | 4.87% |

| 10-Year Treasury Yield | 4.40% | 4.50% |

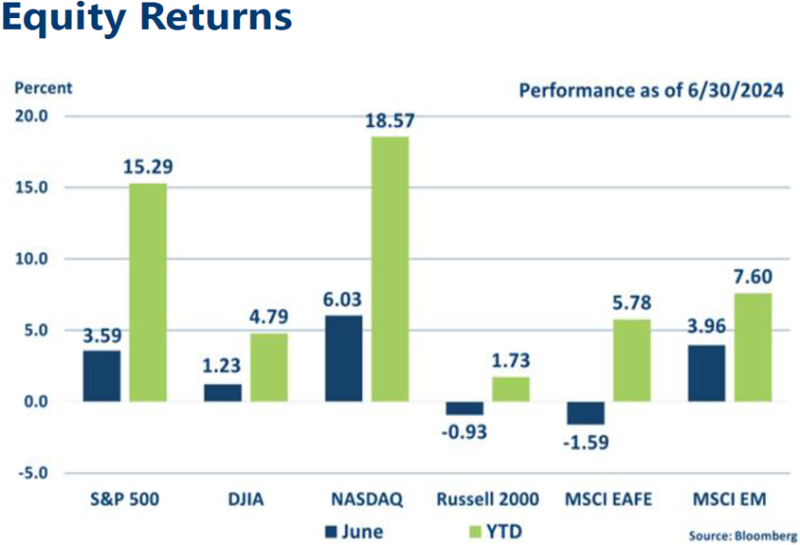

Equities

- Artificial Intelligence stocks had been driving equity returns for some time, and after a brief pause, this trend resumed in May.

- Microsoft, Apple, and Nvidia now make up over 20% of the S&P 500 Index.

- Emerging market stocks jumped, following a European Central Bank rate cut.

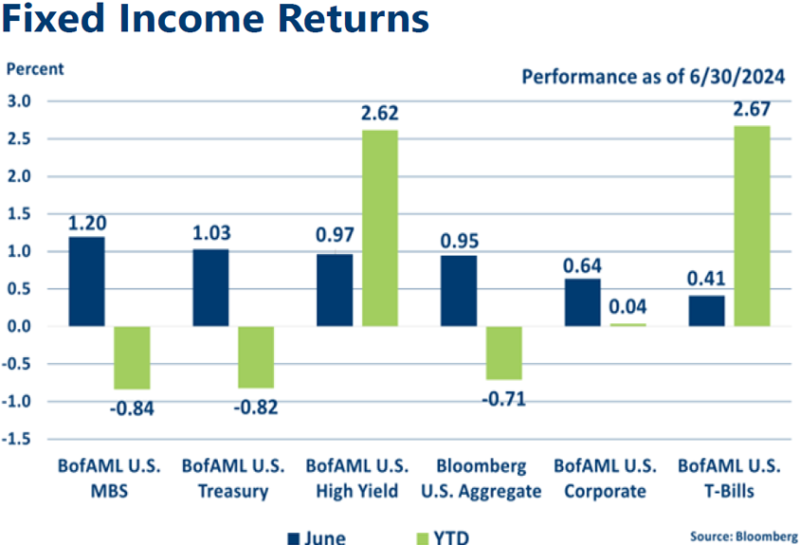

Fixed income

- During its June policy meeting, the Federal Reserve outlined plans for one interest rate cut in the current year and four additional cuts projected for 2025, signaling a shift toward more accommodative monetary policy.

- Lower rates for the second straight month provided solid returns for fixed income investments. However, with rates significantly higher than at beginning of the year, YTD returns remain mostly negative.

Strategic outlook

- Some caution is warranted on equities in the near-term, particularly in high-growth large-cap stocks after recent rally; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.