Market Recap: March 2025

Market commentary

- The Fed adjusted its GDP growth forecast for 2025 down to 1.7% from the previous 2.1%, while slightly increasing its inflation projections for the same period.

- Inflation moved further above the Fed’s 2% target with their preferred measure, the Personal Consumption Expenditures (PCE) index, rising from 2.6% to 2.8%.

- Consumer sentiment started the year at 74.0 but fell to 57.0 in March, marking its lowest point since November 2022.

- Rising domestic and international political tensions, along with government layoffs and uncertainty about future tariffs, are fueling investor insecurity.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 2.4% | 3.1% |

| Consumer Confidence | 92.9 | 100.1 |

| Consumer Price Index Y/Y | 2.8% | 3.0% |

| Core PCE (x food & energy) | 2.8% | 2.6% |

| ISM Manufacturing Index | 49.0 | 50.3 |

| Unemployment Rate | 4.1% | 4.0% |

| 2-Year Treasury Yield | 3.89% | 3.99% |

| 10-Year Treasury Yield | 4.21% | 4.21% |

Equities

- U.S. equity markets declined in March for the second consecutive month with the S&P 500 falling 5.63%.

- Nine of the 11 sectors in the S&P 500 ended lower in March.

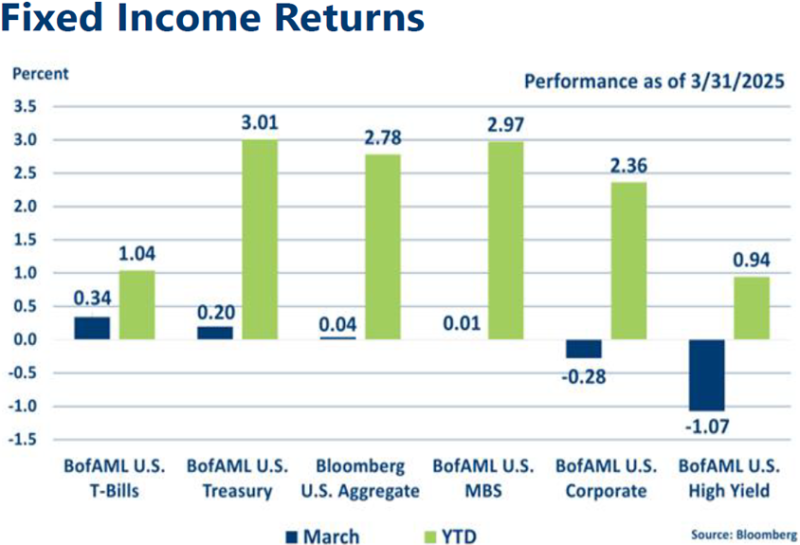

Fixed income

- The Federal Reserve kept rates steady in the March meeting, continuing to take a wait-and-see approach. Expectations for two rate cuts this year remain.

- Treasury yields showed little movement over the month, with the 2-year Treasury experiencing a slight decline and the 10-year yield holding steady at 4.21%.

- Reflecting the equity market decline, both Corporate and High Yield bonds dropped.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns projected for fixed income with the Fed on pause and rates reflective of conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.