Market Recap: November 2024

Market commentary

- The Fed reduced its target rate by 25 basis points; however, economic conditions may persuade the Fed to slow the pace of easing versus earlier expectations.

- Inflation remains above Fed target levels, with the CPI and PCE measures rising slightly in November.

- November saw a rise in consumer confidence, which could be expected to positively impact future GDP growth.

- The U.S. labor market is expected to show signs of recovery in rebounding from a weak October.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 2.8% | 3.0% |

| Consumer Confidence | 111.7 | 109.6 |

| Consumer Price Index Y/Y | 2.6% | 2.4% |

| Core PCE (x food & energy) | 2.8% | 2.7% |

| ISM Manufacturing Index | 48.4 | 46.5 |

| Unemployment Rate | 4.1% | 4.1% |

| 2-Year Treasury Yield | 4.15% | 4.17% |

| 10-Year Treasury Yield | 4.17% | 4.29% |

Equities

- November was a strong month for U.S. equities, led by a nearly 11% gain by the small-cap Russell 2000 Index. Conversely, international markets struggled.

- Strong corporate earnings and expectations of favorable policies under the new administration buoyed optimism.

- Yet, concerns about economic headwinds and geopolitical pressures remain.

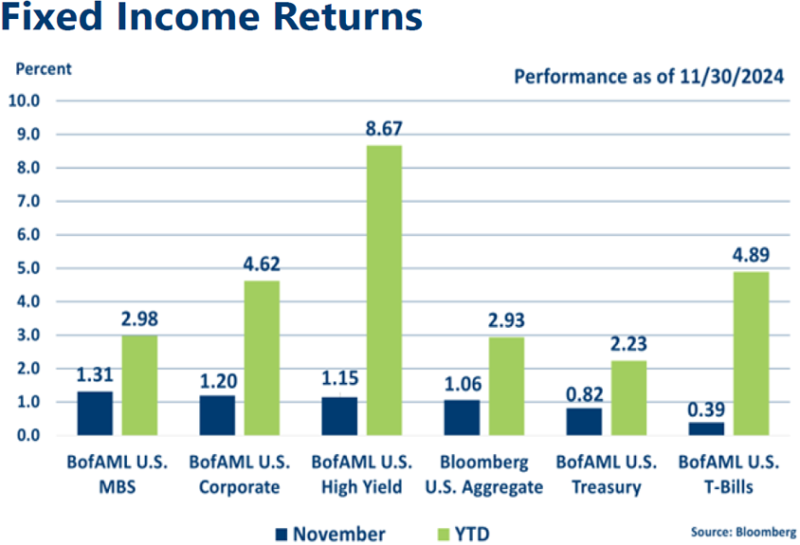

Fixed income

- Following a rate cut by the Fed, U.S. bond yields declined slightly in November. However, a robust economy and shifting expectations for future rate cuts have tempered bond market optimism.

- The yield curve remains very flat, with only 45 basis points separating the highest-yielding Treasury and the lowest.

Strategic outlook

- Some near-term caution warranted on equities, particularly in high-growth large-cap stocks following a period of significant outperformance; currently favoring small- and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.