New life expectancy tables affect RMDs

Updates impact traditional IRAs and inherited IRAs subject to required minimum distributions (RMDs) and life expectancy payments.

People are living longer these days, and from time to time, adjustments are made to life expectancy tables to reflect that. So what does this mean for owners and beneficiaries of IRAs, qualified retirement plan accounts like 401(k)s, and non-qualified annuities?

On January 1, 2022, new life expectancy tables went into effect (it’s been nearly 20 years since the last update), and generally, these updates mean that your required minimum distributions (RMDs) are smaller than in the past. To us, that looks like a good thing — you’ll be taxed less and your account balance could last longer, depending on market performance.

Here’s a nuts-and-bolts look at the details of the new life expectancy tables and their effects:

- New tables went into effect on 1/1/2022

- Updates impact traditional IRA owners in RMD status along with pre-SECURE Act beneficiaries who utilize the single life expectancy table

- Inherited IRAs subject to the 10-year rule are still required to fully distribute by the 10th anniversary year of the DOD

- Traditional IRA owners who turned 72 in 2021 will still determine their 2021 RMD based on the old life expectancy tables (even though they would have until 4/1/2022 to distribute their first RMD). In other words, IRA owners receiving their first RMD cannot reduce the 2021 RMD amount by waiting to take it in 2022.

RMDs for traditional IRAs and inherited IRAs (pre-SECURE)

- RMDs for 2022 may be less than what are required in 2021

- If all things are constant and only the RMD is removed each year, the RMD amount should increase year over year (as the dividing factor is reduced)

- Under the new tables (along with a transition rule for inherited IRAs), traditional IRA owners in RMD status and beneficiaries will likely need to distribute less in tax year 2022

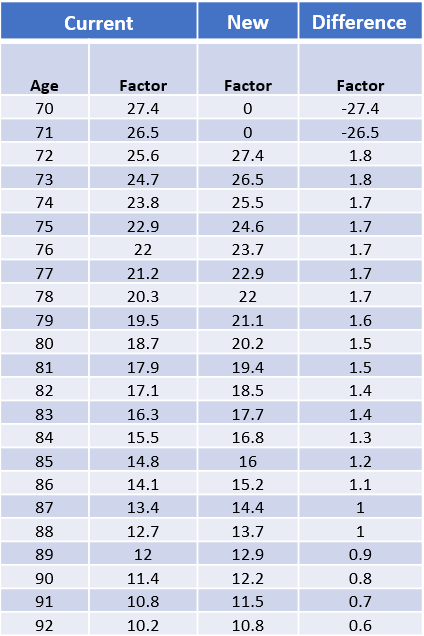

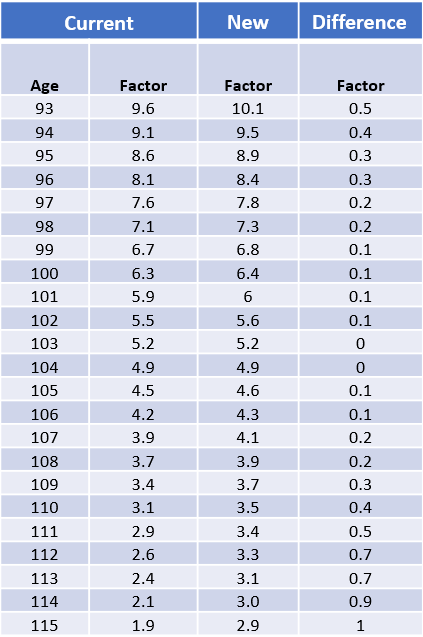

Uniform Lifetime Table: Current vs. New

If you have to start taking required minimum distributions, use these steps and the tables below to calculate the amount of your RMD:

- Your IRA balance on December 31 of the previous year.

- Distribution period from the table below for your age on your birthday this year.

- Line 1 divided by number entered on line 2. This is your required minimum distribution for this year from this IRA.

- Repeat steps 1 through 3 for each of your IRAs.

Simply put: Prior year’s December 31 account value, divided by your life expectancy factor, equals RMD

Example: Maggie is 80 and has an IRA with a balance of $120,000 as of December 31 of the previous year. According to the IRS Uniform Lifetime Table below (New column), her life expectancy is 20.2 years.

120,000 / 20.2 = $5,940.59 RMD

As with many things in life, there are exceptions — please consult your own advisors regarding your specific situation regarding RMDs.

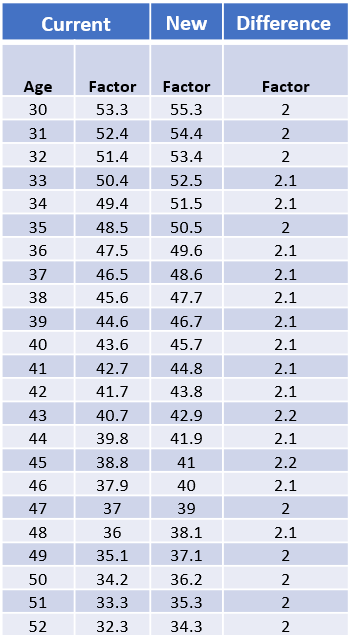

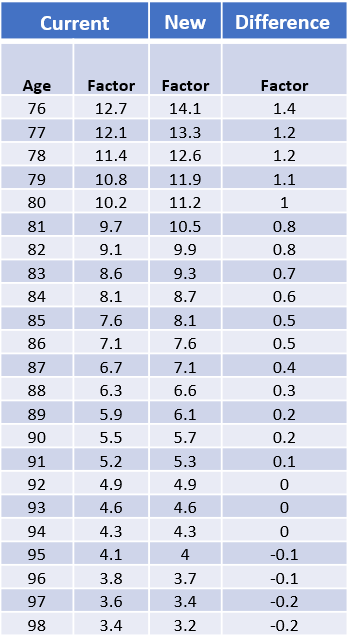

Single Life Expectancy Table (non-recalculate): Current vs. New

If you’re a beneficiary inheriting an IRA, there are a couple factors that can affect how your life expectancy payment is calculated:

- The date of the original owner’s death (particularly if they passed away prior to the SECURE Act on 1/1/2020)

- The age of the beneficiary as of 12/31 of the year following the original owner’s death.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.

|