Market Recap: July 2024

Market commentary

- The first estimate of second-quarter GDP indicates the economy expanded at a 2.8% annual rate, besting forecasts, and up from a 1.4% rate in the first quarter.

- Federal Reserve officials made no changes to short rates at the July meeting. While indicating that inflation is getting closer to its 2% target, they also implied the need for further progress.

- Core PCE, the Fed’s preferred inflation gauge, was unchanged from the previous month, rising by 2.6% in June.

- The unemployment rate crept slightly higher, increasing to 4.1%, the highest rate since early 2018 (excluding the pandemic).

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 2.8% | 1.4% |

| Consumer Confidence | 100.3 | 100.4 |

| Consumer Price Index Y/Y | 3.0% | 3.3% |

| Core PCE (x food & energy) | 2.6% | 2.6% |

| ISM Manufacturing Index | 46.8 | 48.5 |

| Unemployment Rate | 4.1% | 4.0% |

| 2-Year Treasury Yield | 4.26% | 4.76% |

| 10-Year Treasury Yield | 4.03% | 4.40% |

Equities

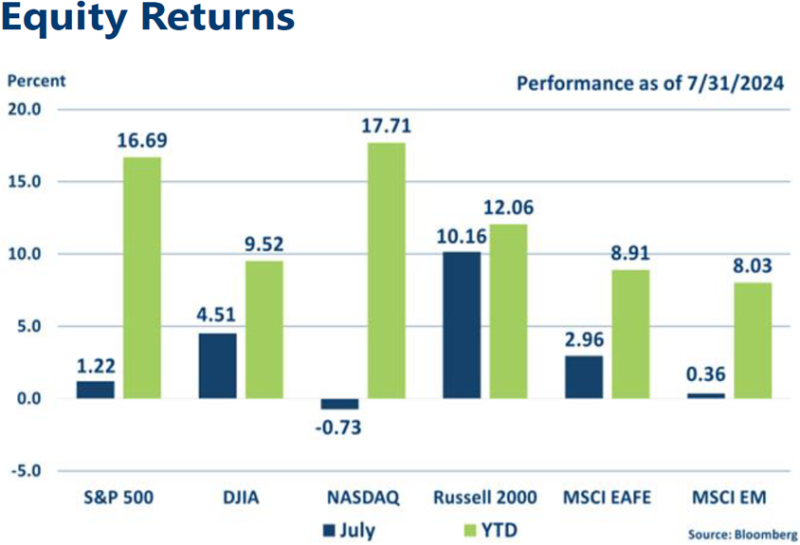

- Reversing trends, the Communication Services and Information Technology sectors declined in July, while all others advanced. Subsequently, the tech-heavy S&P 500 and NASDAQ indices lagged.

- Growing expectations of rate cuts drove small-caps higher for the month, with the Russell 2000 posting double-digit returns.

Fixed income

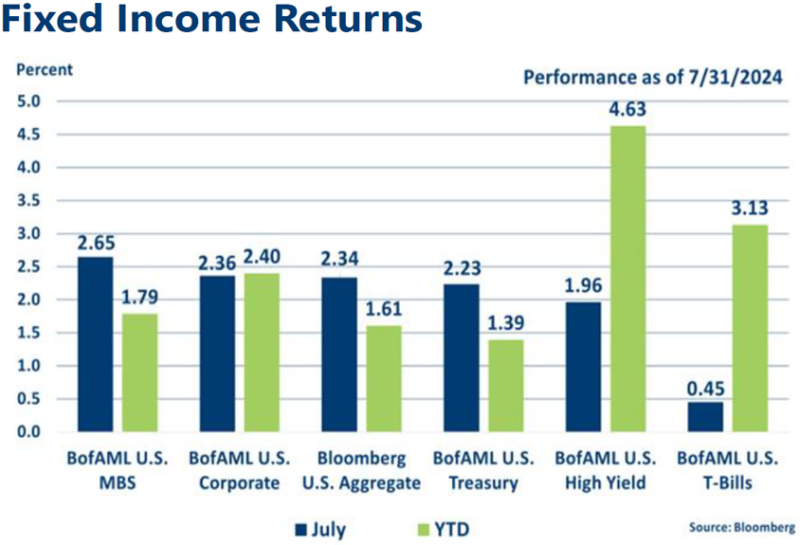

- Rates continued lower in July, leading to another month of strong bond returns while YTD returns turned positive.

- The yield curve continued to progress toward a more “normal” shape, with the gap between 2-year and 10-year Treasury yields narrowing.

Strategic outlook

- Some caution is warranted on equities in the near-term, particularly in high-growth large-cap stocks after recent rally; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns are projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.