Market Recap: October 2024

Market commentary

- Real GDP growth is projected to average 2.7% for 2024, with a slight slowdown expected in 2025.

- Consumer spending remained buoyant but shows signs of slowing, especially among those facing higher debt costs.

- The U.S. economy added only 12,000 jobs in October, which was far fewer than expected. However, the unemployment rate remained steady at 4.1%.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 2.8% | 3.0% |

| Consumer Confidence | 108.7 | 99.2 |

| Consumer Price Index Y/Y | 2.5% | 2.5% |

| Core PCE (x food & energy) | 2.7% | 2.7% |

| ISM Manufacturing Index | 46.5 | 47.2 |

| Unemployment Rate | 4.1% | 4.1% |

| 2-Year Treasury Yield | 4.17% | 3.64% |

| 10-Year Treasury Yield | 4.29% | 3.78% |

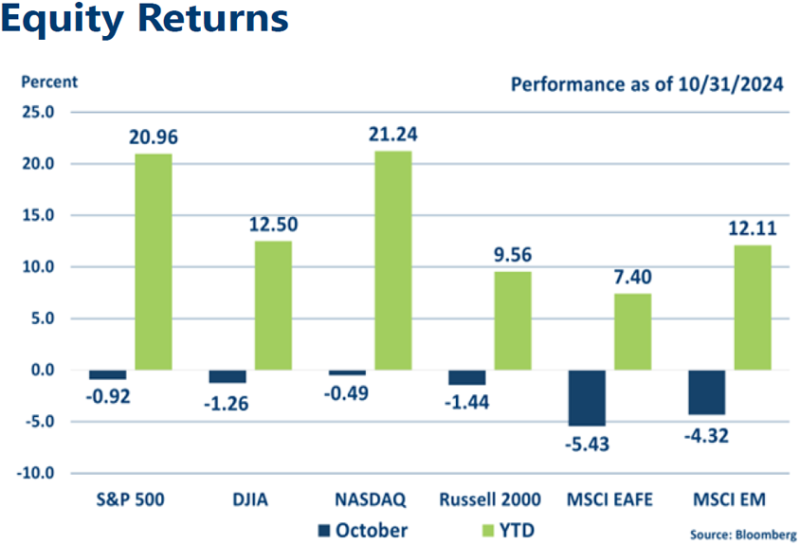

Equities

- Largely positive until the last trading day, domestic equities sold off dramatically on the 31st, resulting in losses for October.

- The month saw substantial volatility, with concerns about economic growth impacting investor sentiment.

- While the U.S. economy showed resilience, some foreign economies faced slower growth or recessions, negatively impacting foreign stock returns.

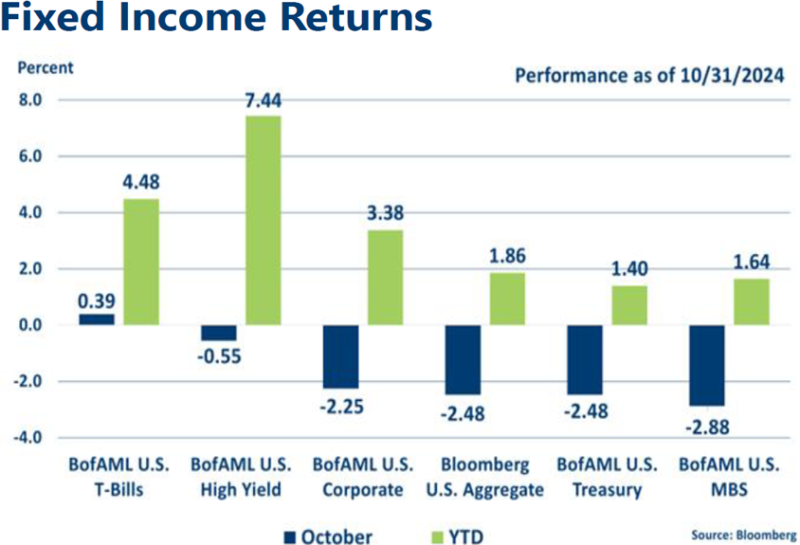

Fixed income

- Treasuries posted a loss in October, the first since April and biggest since 2022, as U.S. economic performance cast doubt on the outlook for additional Fed cuts.

- Yields on maturities one year and longer climbed, led by the 5-year, which rose 60 basis points, while all maturities from two years and longer reached their highest levels since at least early August.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in high-growth large-cap stocks after recent rally; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.