How to boost your cash flow with your credit card

Managing how your money moves is important; after all, proper cash flow management can mean the difference between overdrawing your account and having a cushion at the end of the month. With the right approach, a credit card can be used as an essential tool, helping to improve your finances and better manage your cash flow. Let’s talk about different scenarios in which this approach would make sense.

Paying your regular bills (or managing irregular income)

One strategy for using credit cards to manage your cash flow is to pay your monthly bills with your credit card, then pay it off at the end of each month — after you've had a month for your pay to accumulate. This can be especially helpful if you have irregular income. There are just a few important cash flow management concepts to remember that will keep your personal finances out of the red when your income isn’t always black and white.

For starters, you’ll want to know your baseline — i.e., the minimum amount you earn in a month. Just look at your lowest-paid month in the last year. Calculate how much you earned; that’s your maximum amount to spend. Any cash back or credit card rewards can be added to your budget, but aim to put additional income in savings. Save your income as it accumulates, paying it back at the end of your billing cycle.

When you need a loan

Maybe the car needs a new muffler, the AC unit needs repairs, or your favorite furry family member just racked up crazy-high vet bills. Maybe you haven’t yet built up your emergency savings to sustain this kind of a hit (or maybe it’s there, but you’re afraid that if you dip into savings, you might not pay it back). One alternative is a controlled, disciplined cash flow boost, using your credit card as a short-term loan. The credit available on your credit card is unsecured, so it requires no lengthy application process when you need some cash flow relief. However, you will want to set some guidelines and follow good credit management practices to avoid a vicious cycle of high balances, interest rates, and possible fees.

It’s best to “lend” yourself money using your credit card when it can be repaid in a relatively short time frame. From a cash flow perspective, the very best charge on a credit card is one that you can repay before any interest is charged, because this is free money until the end of the billing cycle. If you know that a charge will be carried over several months, it’s still not the end of the world and may be the best course of action. Calculate the interest you will pay on that purchase and budget accordingly when you are planning for repayment.

Getting some grace

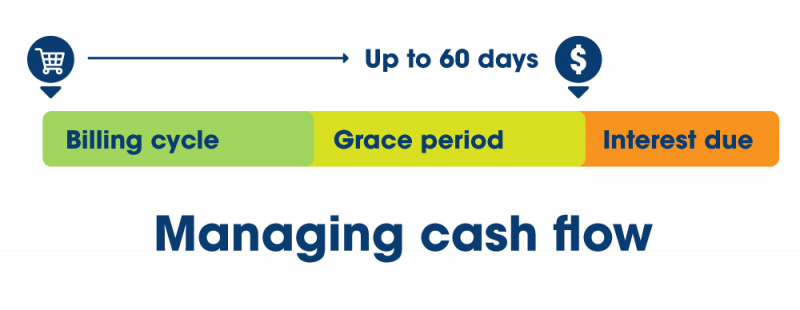

Almost every credit card has a grace period that applies to regular purchases, but usually not balance transfers. This sweet spot is when your balance does not accrue interest. Typically, this occurs in the period from your first charge (or purchase) until your bill is due. That can mean a period of up to 60 days between when you use your card and when you need to pay for that expense.

Filling the gaps

What your credit card grace period means for your cash flow is that, if you encounter a sticky situation where cash flow is low at the end of the month, shifting your expenses to a credit card that recently billed will extend the time period until your payment by a significant number of days. Just remember, this method of using credit cards to organize your inbound and outbound cash requires extra diligence.

Want more expert advice and helpful info on credit cards? Click here.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.