Market Recap: May 2024

Market commentary

- The U.S. economy grew at a slower pace of 1.3% annualized rate from January through March, revised down from an initial estimate of 1.6%.

- Despite this slowdown, and after three straight months of decline, U.S. consumer confidence increased in May.

- Indicating a tightening labor market, the U.S. economy added only 175,000 jobs in April, representing the lowest total since October 2023.

- Following April’s unexpected spike, CPI retreated slightly, although inflation remained above levels seen earlier this year.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 1.3% | 3.4% |

| Consumer Confidence | 102 | 97.5 |

| Consumer Price Index Y/Y | 3.4% | 3.5% |

| Core PCE (x food & energy) | 2.8% | 2.8% |

| ISM Manufacturing Index | 48.7 | 49.2 |

| Unemployment Rate | 3.9% | 3.8% |

| 2-Year Treasury Yield | 4.87% | 5.04% |

| 10-Year Treasury Yield | 4.50% | 4.68% |

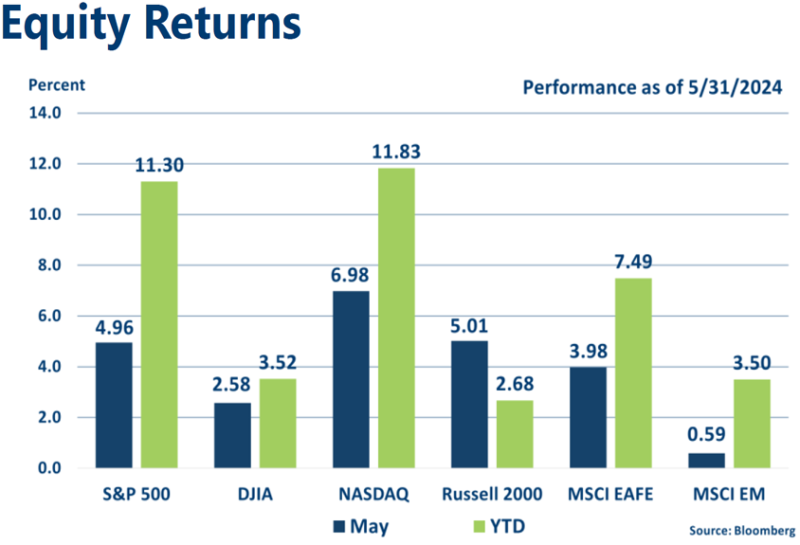

Equities

- U.S. stocks broadly got a boost from easing Treasury yields after the latest reading on inflation came in roughly as expected.

- Historically the second worst month for stocks, May delivered strong returns, especially in technology and interest-rate sensitive stocks.

- Both the S&P 500 and Nasdaq Composite recorded five consecutive weeks of gains.

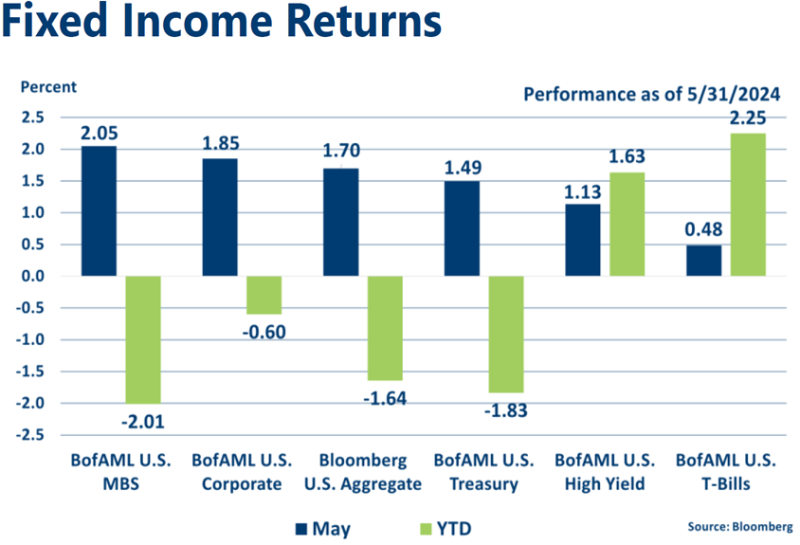

Fixed income

- Lower rates led to strong returns across the spectrum of fixed income investments.

- An expected $340 billion net increase in U.S. government bonds for June should test investors’ appetite for debt and could provide some upward pressure on yields.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in high-growth large-cap stocks after recent rally; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.