Why diversification is as important as ever

2021 was another fantastic year for investing in stocks. Returns for the widely followed S&P 500 Index have exceeded our expectations, returning more than 25% for the year through mid-December. Most other major market averages are also solidly in positive territory for the year, although they’re lagging the large-cap, U.S.-centric benchmark by a wide margin. These trends have been in place for some time — 10-year trailing returns are among the best in history for the S&P 500, at around 16% annually. Again, most major market averages have also enjoyed healthy returns, but not at the same level, and in some cases have significantly lagged the S&P 500.

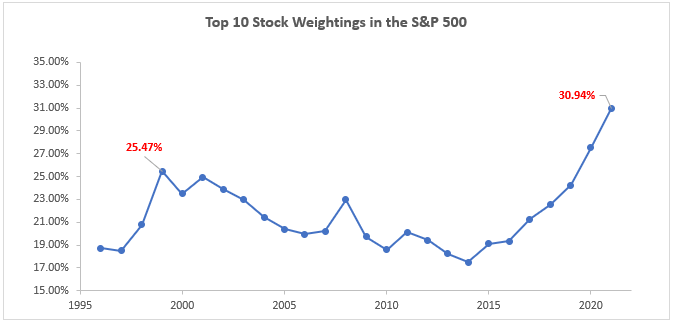

After reviewing this data, an investor may question the point of diversification. After all, even though we all understand the general point of not having all of our metaphorical eggs in one basket, does it really matter if one of those “eggs” always seems to outperform? This is exactly the point where we believe it makes sense to take a closer look. While it’s true that the S&P 500 is a diverse index of leading U.S.-based companies, the driving force behind its exceptional performance is centered around a handful of companies. The chart below shows how top-heavy the index has become, with the top 10 companies accounting for nearly one-third of the entire index. This is well above levels seen in 1999, the last time we saw a peak in this type of concentration.

So what might happen next? The decade following 1999 was the exact time that diversification mattered most. U.S. large-cap stocks had what is referred to as a “lost decade,” while other areas of the market, including small-cap and international stocks, did relatively better. While history is unlikely to repeat itself, the setup for the next several years may resemble what we have experienced in the past. There’s no question that the biggest U.S. companies are fantastic entities, and they’re sure to remain a significant part of our equity portfolios. However, we believe shifting into other less expensive areas of the equity markets will provide true diversification benefits (lower risk and better returns) as we look forward.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.

|